Housing boom was a bust for African Americans

19th October 2015 · 0 Comments

By Jill Rosen

Contributing Writer

(Special from NorthStarNews Today) – In the roller coaster ride that was the U.S. real estate market in the first decade of this century, some U.S. homebuyers found wealth while others took big hit — often depending on when they bought.

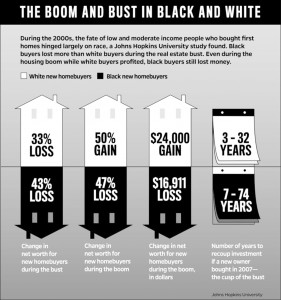

But no matter when he or she purchased, the average low- to middle-income Black first-time homeowner lost money, a Johns Hopkins University study finds. The average low- to moderate-income African-American lost net wealth after buying a home in the 2000s, even if he or she bought when the market was rising. “They would have done better if they’d stayed renters,” researcher Sandra Newman says.

Researchers Sandra J. Newman and C. Scott Holupka found that race was a key determinant of which low- and moderate-income people who bought first homes during the decade made money.

Big losses during the boom years

During the Great Recession, white homebuyers on average lost money but Black ones lost considerably more. Even during the boom years, when white buyers on average increased their wealth by 50 percent, Black buyers lost 47 percent of their wealth.

“They say that in real estate timing is everything but Blacks had a loss across the decade — even when their purchase time was impeccable,” says Newman, a professor at the university’s Institute for Health and Social Policy. “They would have done better if they’d stayed renters.”

The main factor in whether white buyers made money on their homes was when they bought. But timing had little to do with it for Black buyers, the researchers found. Instead, the driver was the neighborhoods they bought into—and often those areas were predominantly Black, with lower housing prices, lower appreciation and declining rates of homeownership.

For Black buyers, education and marital status were also key predictors of how the purchase would affect their assets, though neither influenced the return on investment of white buyers.

The researchers analyzed data from the Panel Study of Income Dynamics, looking in particular at how the net worth of renters was affected by buying a home at different points in the decade — in the wake of the 2001 recession, in 2003 when the market was heating up, at the height of the boom in 2005, and at the onset of the Great Recession in 2007.

The study, published in the journal Real Estate Economics, focused on first-time buyers, long time targets of campaigns to increase wealth through homeownership. About 40 percent of all homebuyers are first-time buyers and more than 60 percent of those buyers are of low-to-moderate income.

Survey data highlights stark disparities by race

During the Great Recession, between 2007 and 2009, the net worth of new white homebuyers dropped 33 percent, while new Black homebuyers lost 43 percent of their wealth.

During the boom, between 2005 and 2007, white first-time buyers enjoyed net worth gains of 50 percent while new Black homebuyers lost 47 percent. In dollar terms, while whites were gaining on average about $24,000, Blacks were losing $16,911.

“We had to convince ourselves that during one of the hottest housing markets ever, our numbers were showing Black buyers still experienced losses,” Holupka says. “It was sort of stunning.”

To project the number of years it would take home buyers who bought during the bust to recoup their investment, the researchers ran simulations. For white buyers who bought in 2007, they projected it would take from three to 32 years, depending on the market, to get their money back.

“It will take Blacks more than twice as long,” Newman says, about seven years in the best-case scenario to about 74 years in a weak market.

Jill Rosen is affiliated with John Hopkins University.

This article originally published in the October 19, 2015 print edition of The Louisiana Weekly newspaper.